2025 Tax Brackets Head Of Household In India. By providing inputs with respect to income (s) earned and deductions claimed as per the act. Updated on august 13, 2025 , 108215 views.

Under the income tax act, 1961, the percentage of income payable as tax is based on the amount of income you’ve earned during a year. For example, if you paid $10,000 in taxes on a taxable income of $50,000, your effective tax rate would be 20% (10,000/50,000 = 0.2).

Tax Brackets 2025 India Evvie Wallis, Qualified dependents are people such as children, grandchildren, or a parent.

Tax Slab For Ay 202425 In India Noell Angelina, The highest earners fall into the 37% range, while those who earn the.

2025 Tax Brackets Single Head Of Household Edie Nettie, Paying income tax is a duty of every indian citizen.

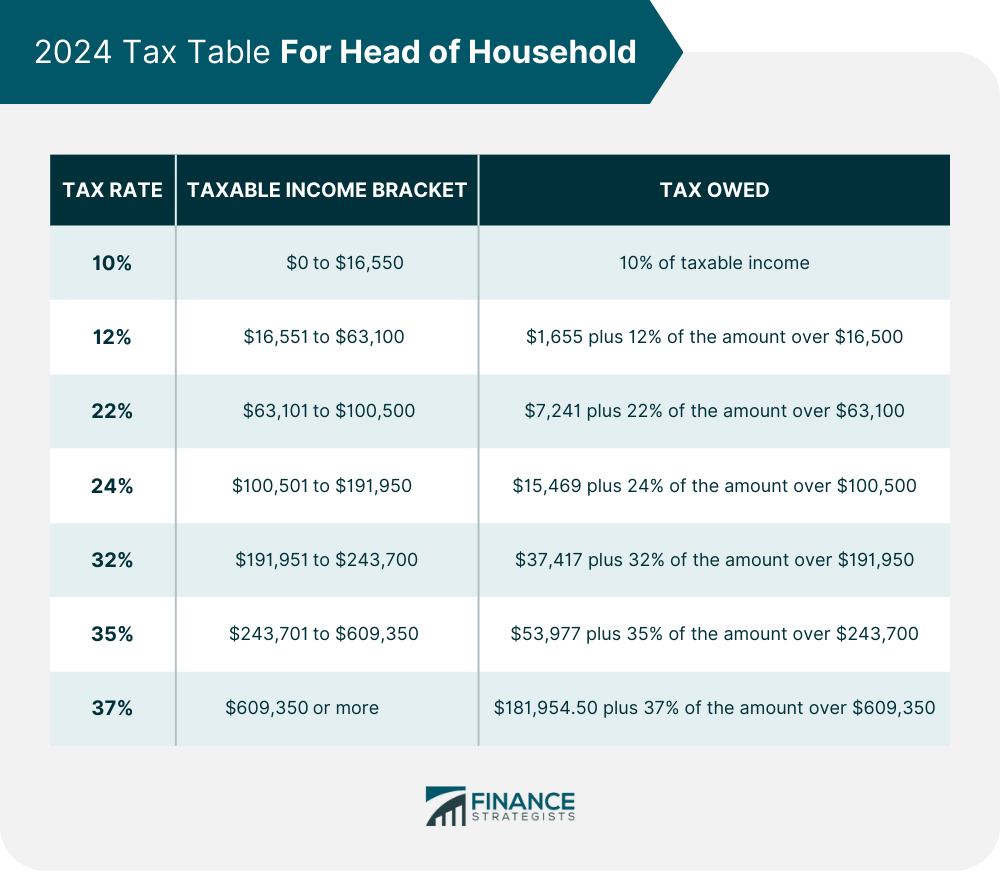

Tax Brackets Definition, Types, How They Work, 2025 Rates, The federal income tax has seven tax rates in 2025:

2025 Tax Brackets Single Head Of Household Dotti Loreen, 2025 standard deduction amount increases too.

Tax Brackets 2025 Head Of Household Kirby Suzanna, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

2025 Tax Brackets Head Of Household Danila Delphine, Paying income tax is a duty of every indian citizen.

New Tax Brackets 2025 Head Of Household Flore Jillana, A look at the 2025 income tax brackets for single filers, married filers, head of household.

Head Of Household Tax Brackets 2025 Darya Emelyne, Paying income tax is a duty of every indian citizen.